Nickel has long had a reputation for being among the most volatile industrial metals, but its biggest daily jump in a decade has left even the most seasoned traders astonished.

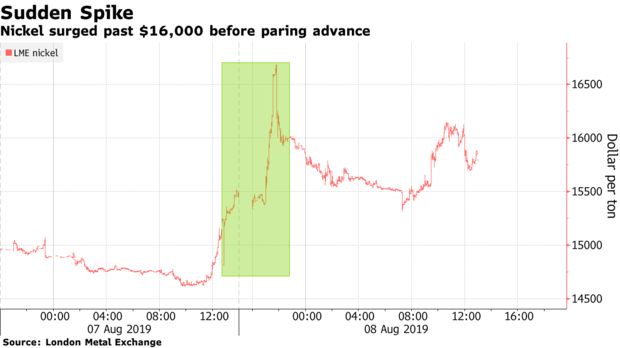

The metal surged as much as 13%, or almost $2,000 a ton, extending a rally over the past month triggered by speculation that top producer Indonesia might bring forward a ban on nickel ore exports. While the price eased after the nation’s mining ministry denied that any policy changes are imminent, it closed 7.2% higher in London to the highest in more than four years.

“You can see that the market is barely trading now because people just don’t know what to do,” said George Daniel, a hedge fund manager at Red Kite who’s been trading metals since 1993. “It could come off from here, but everyone’s just waiting to see if China comes in and buys it again.”

Nickel has in recent years become one of the most actively traded contracts on the London Metal Exchange as short-term investors have been drawn to its sharp price moves. Trend-following funds have added fuel to the recent rally, as have options traders who were forced to hedge their exposure as prices started surging late Wednesday, Daniel said.

Nickel touched $16,690, the highest since April 2018, and settled up $1,070 to $15,880 at 5:51 p.m. in London, the highest closing price since December 2014. Shanghai Futures Exchange contracts surged by the daily limit, reaching the highest since trading began in 2015.

Source: www.bloomberg.com; estainlesssteel.com